AnnaPrintables.Org | Free 1099 Tax Forms Printable — This page indexes publicly available Free 1099 Tax Forms Printable published on third-party sites. No content is hosted on the creators’ websites. Links direct users to the source page where the printable can be printed at no cost.

Thumbnails are displayed for identification and are not the final files. All intellectual property rights are held by the publishing parties. Ownership claims should be submitted via email.

Free 1099 Tax Forms Printable

Free 1099 Tax Forms Printable

Disclaimer: AnnaPrintables.Org does not create any printable content. This site functions as a directory to openly published resources. Use is subject to the creator’s terms.

Free 1099 Tax Forms Printable Images Gallery

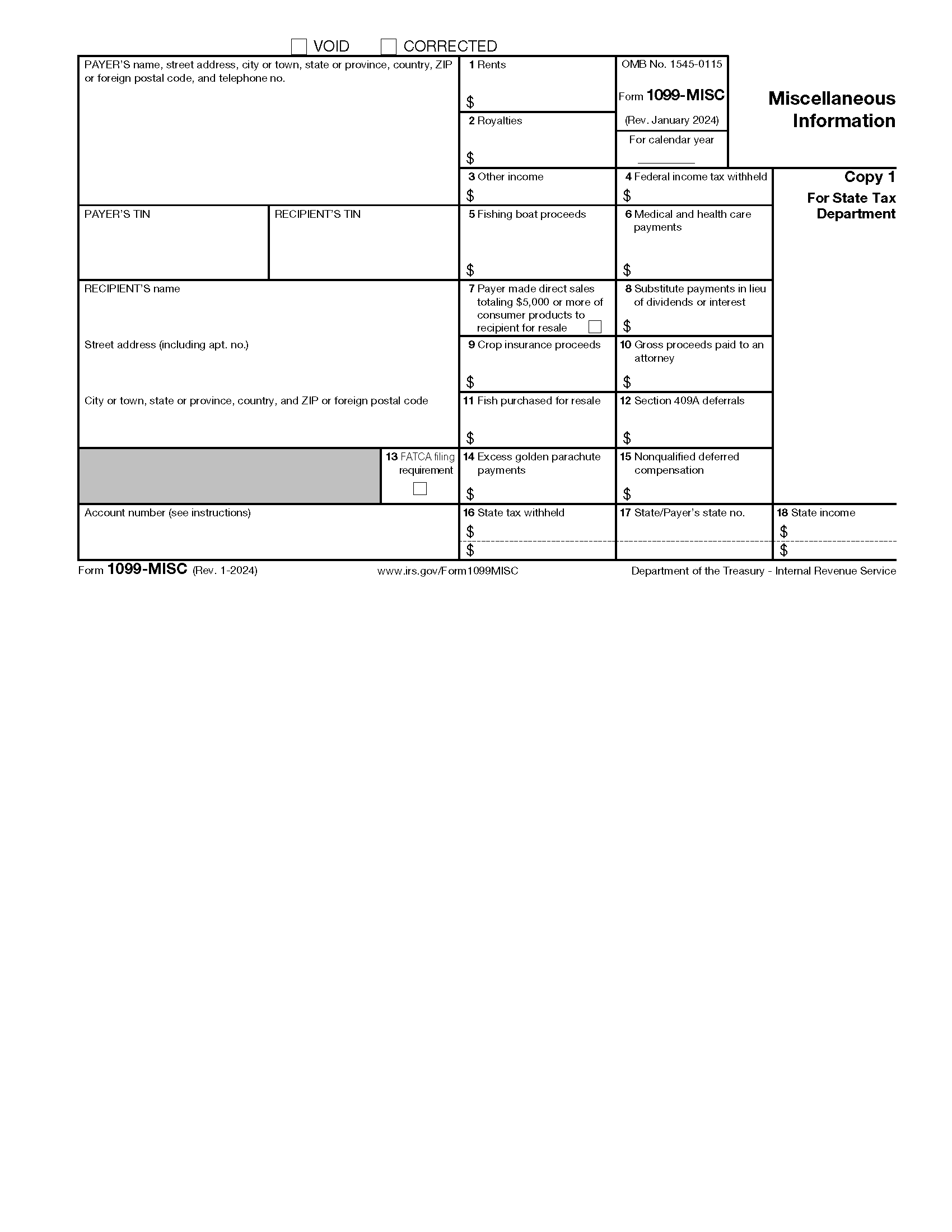

2024 IRS Form 1099-MISC | Fill Out & Save With Our PDF Editor

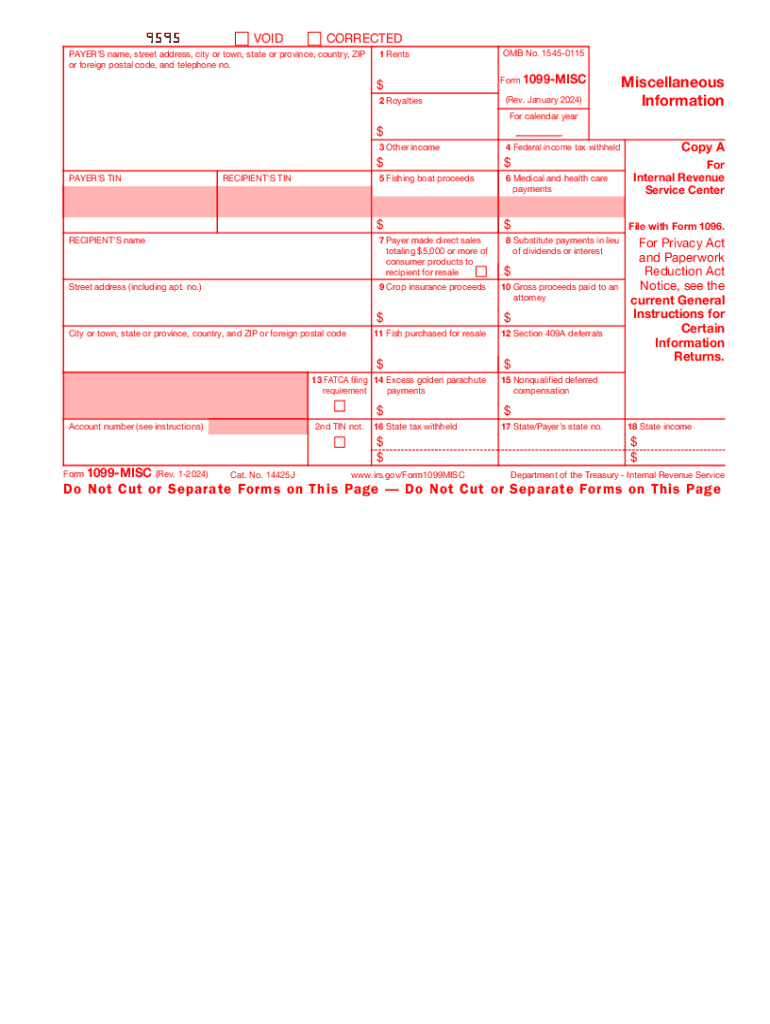

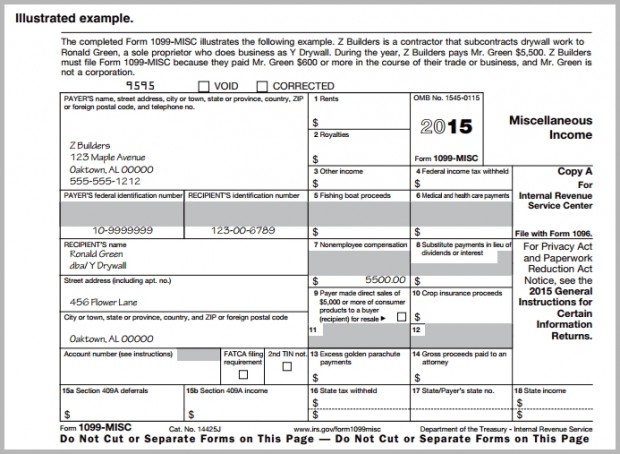

Printable IRS Form 1099-MISC for 2015 (For Taxes To Be Filed in 2016)

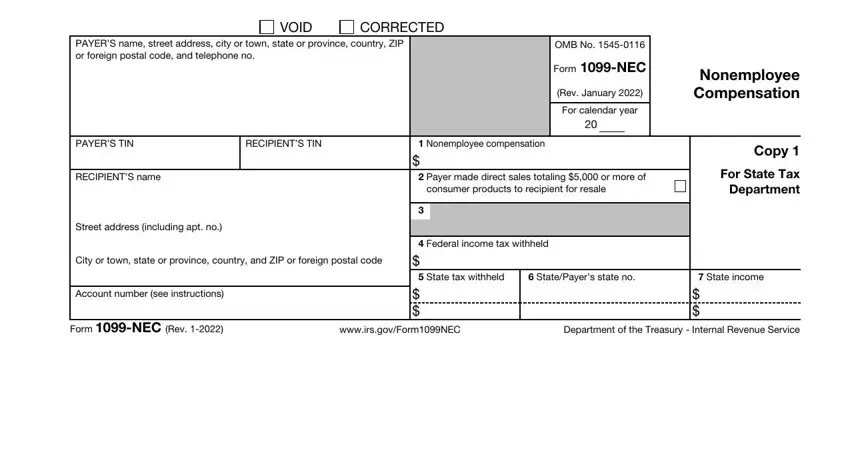

IRS Form 1099-NEC ≡ Fill Out Printable PDF Online

Intuit QuickBooks 1099-NEC Tax Forms Set - DiscountTaxForms

1099 Form Online | Make Instant Form 1099 FREE | PayStub Direct

How to Print and File 1099-MISC, Miscellaneous Income

How to fill out IRS 1099-MISC form PDF 2025 | PDF Expert

Nc 1099 form printable: Fill out & sign online | DocHub

1099-K Software to Create, Print & E-File IRS Form 1099-K

W-2 and 1099 Template

Frequently Asked Questions

1. What is the source of these printables?

All printables originate from educational platforms. This site does not upload any content.

2. How do I access the full-resolution file?

Click through to the original page (typically below or near the preview) to download the original file.

3. In what format are the files provided?

Most creators distribute files in JPG format. These are widely supported.

4. Are these files editable?

Only if specified by the creator. Most free printables are non-editable to protect design integrity.

5. Can I sell products using these?

Not without explicit permission. Free printables are intended for personal use.

6. How often are links verified?

Links are not monitored in real time. Report broken links via the support form for correction.