AnnaPrintables.Org | Free Irs Tax Forms Printable — This page references publicly available Free Irs Tax Forms Printable published on third-party sites. No content is hosted on the creators’ websites. Links direct users to the download location where the printable can be accessed at no cost.

Thumbnails are displayed for reference and do not represent full resolution. All intellectual property rights are held by the publishing parties. Removal or attribution requests should be submitted via the contact page.

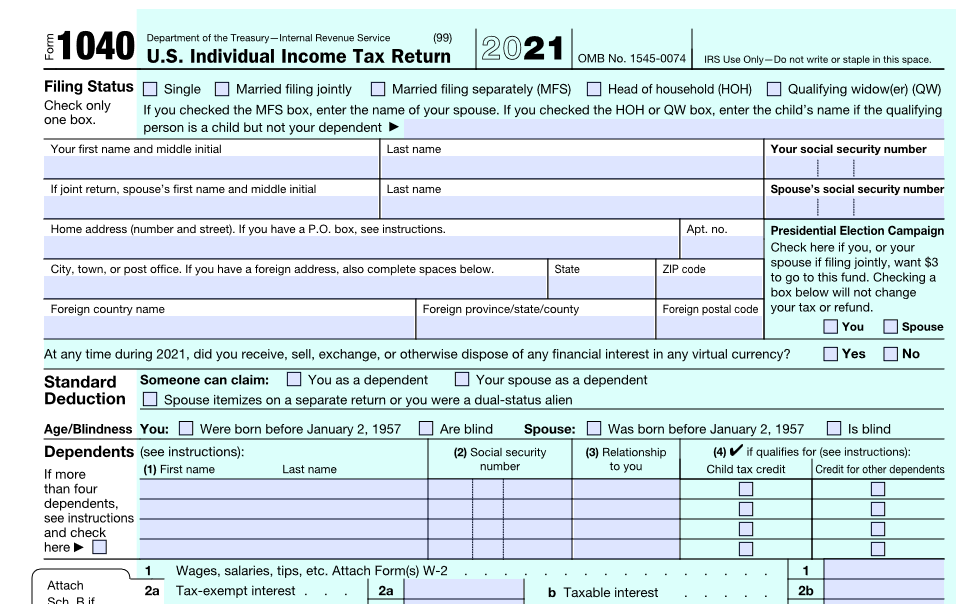

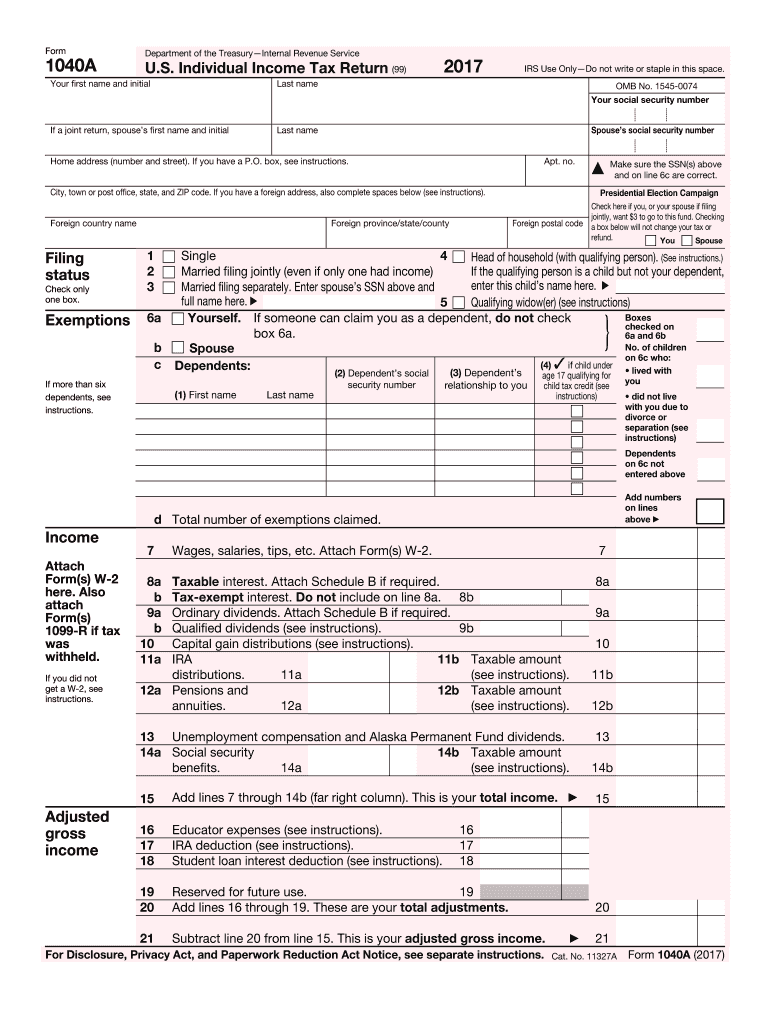

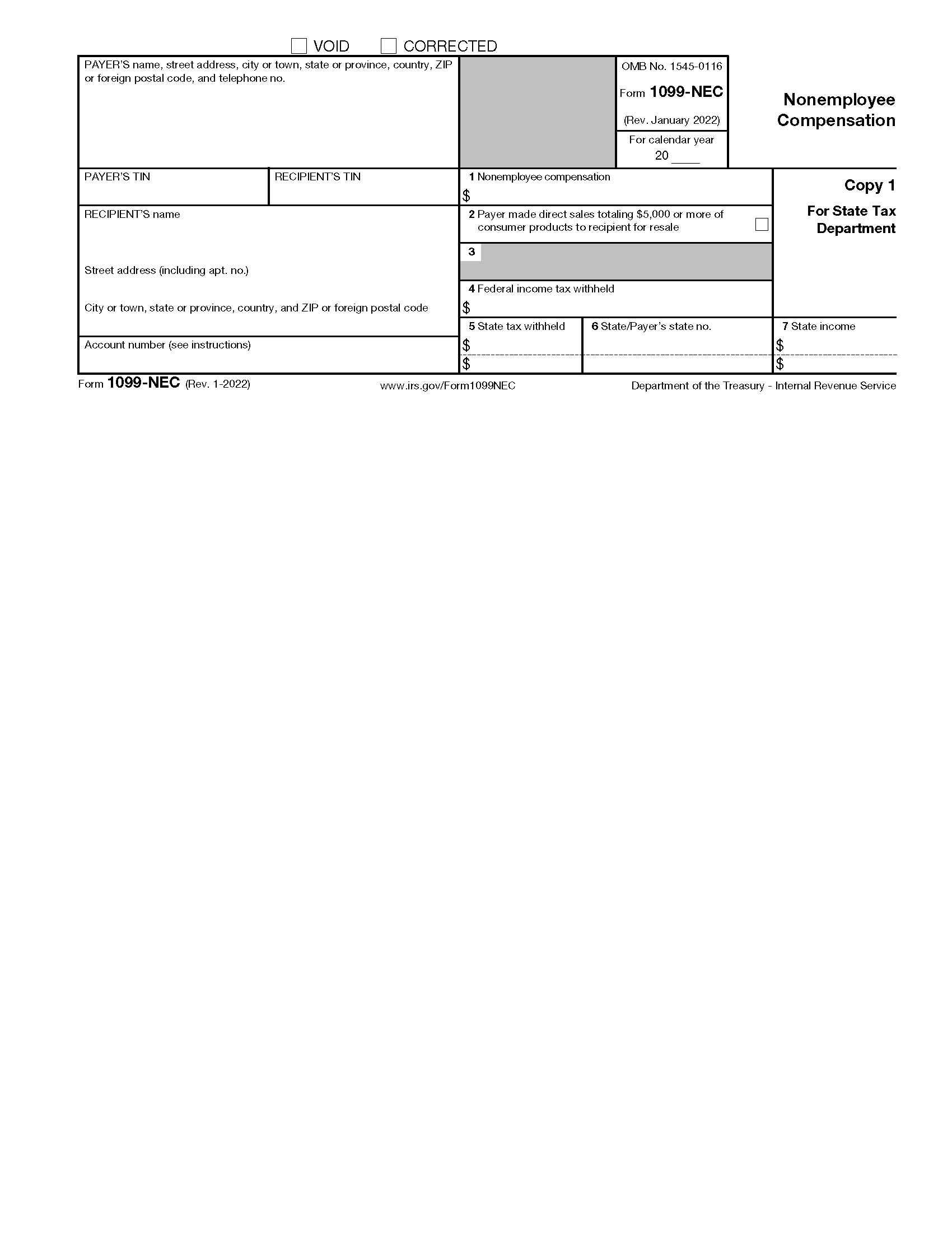

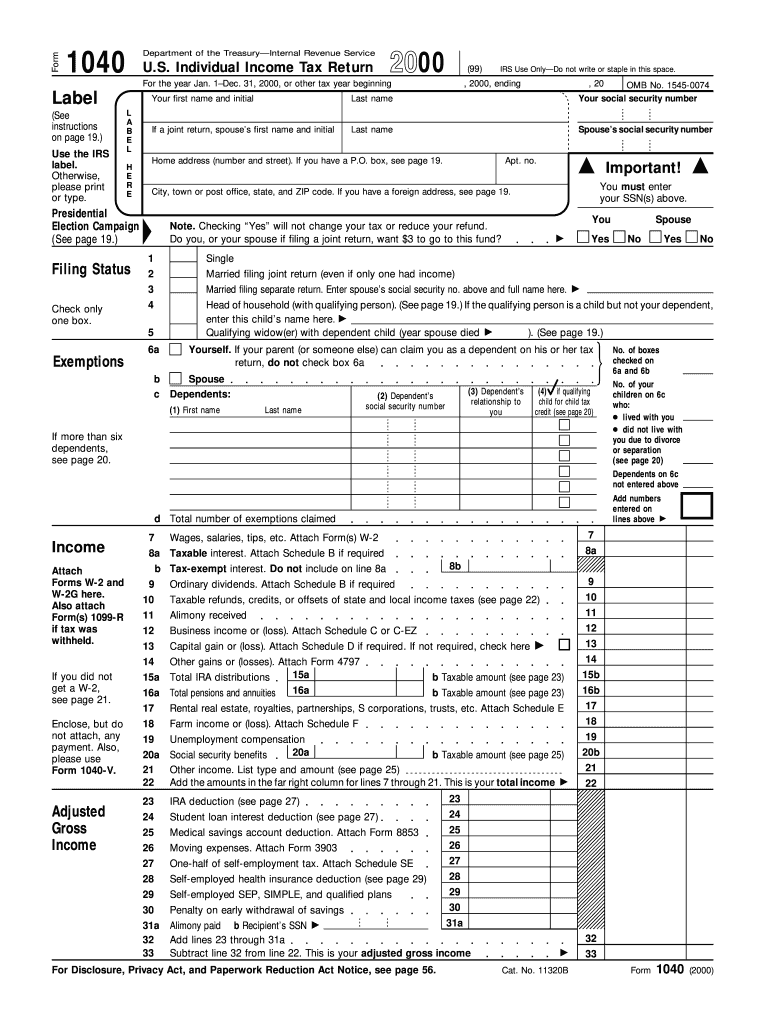

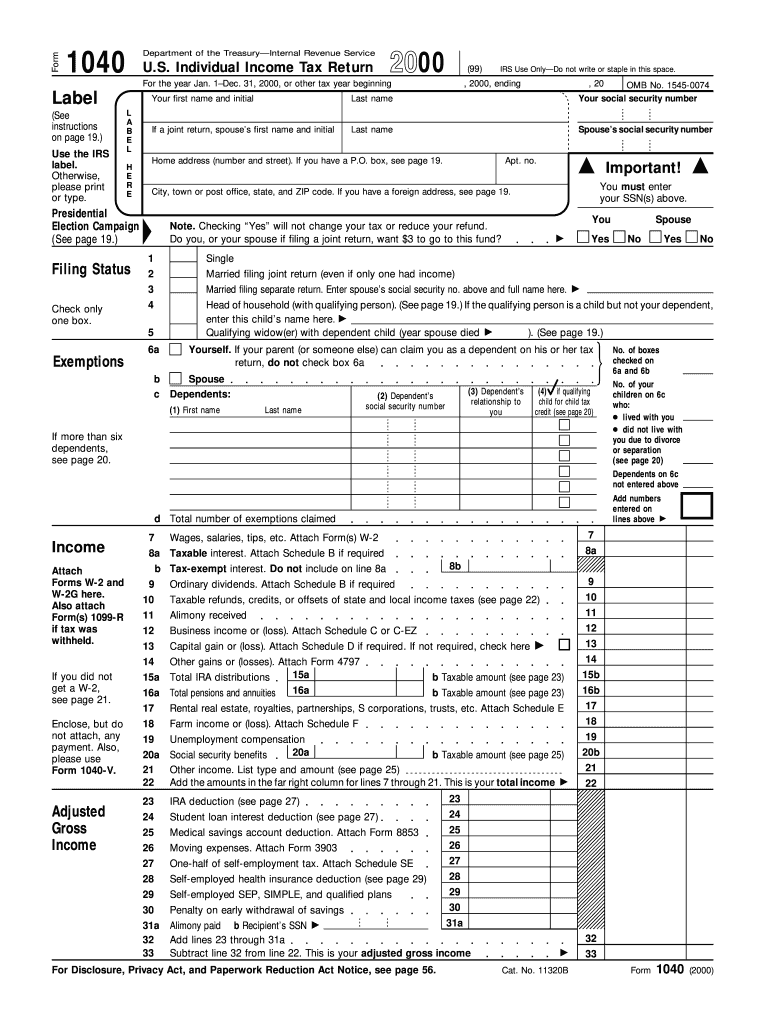

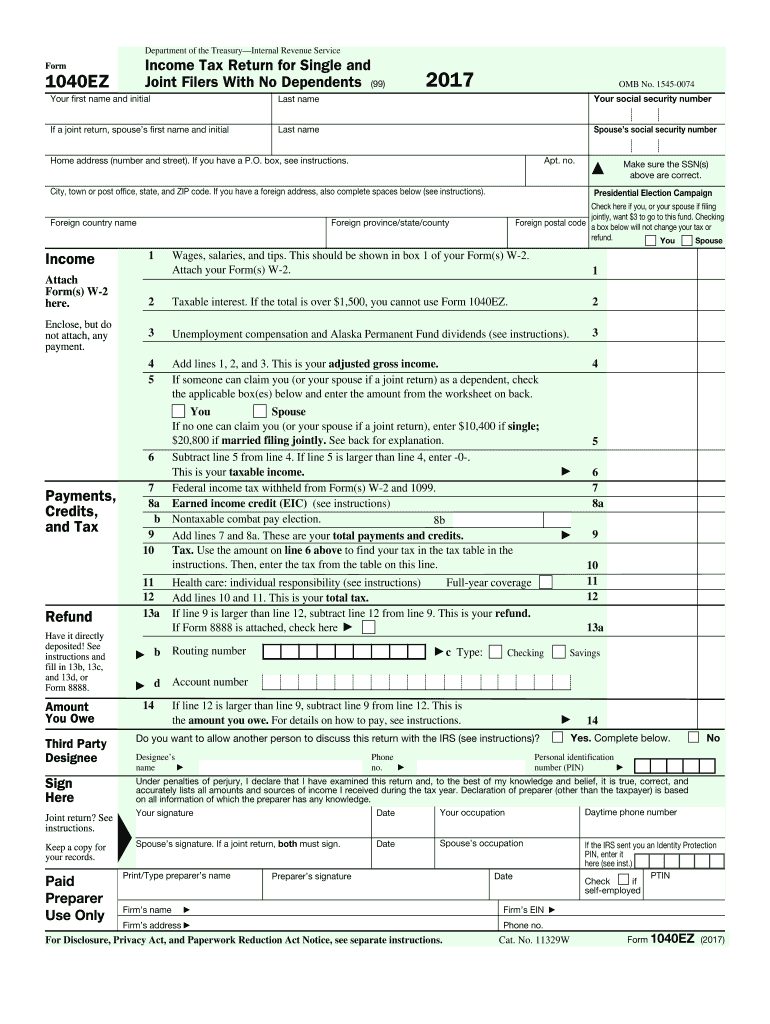

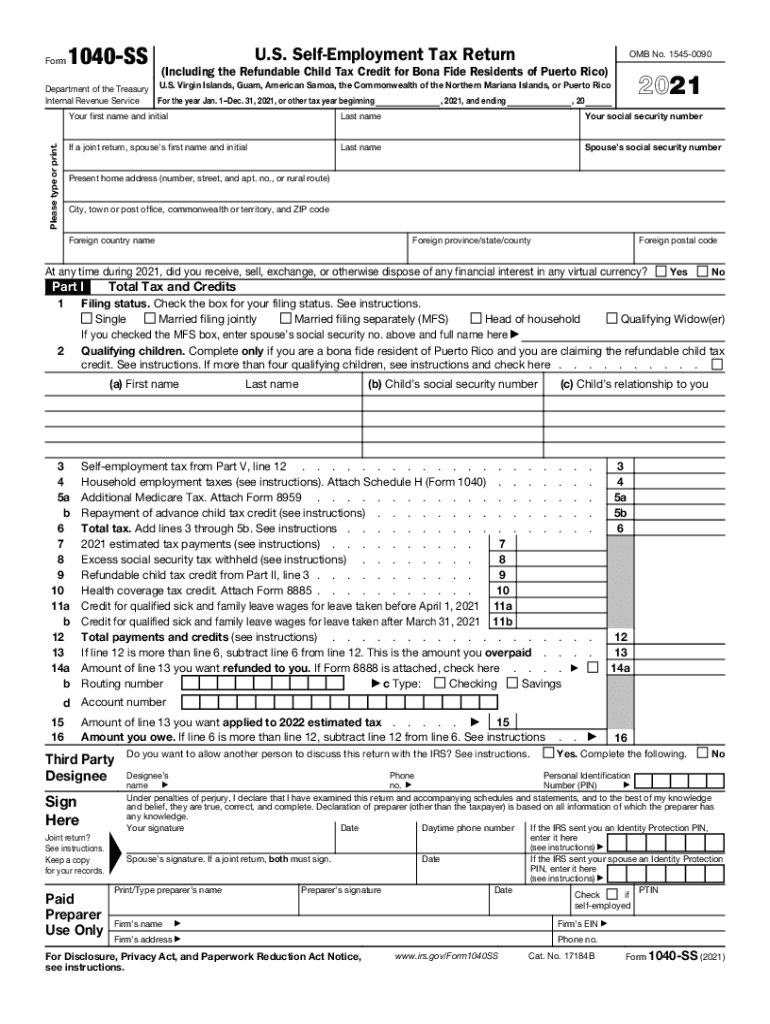

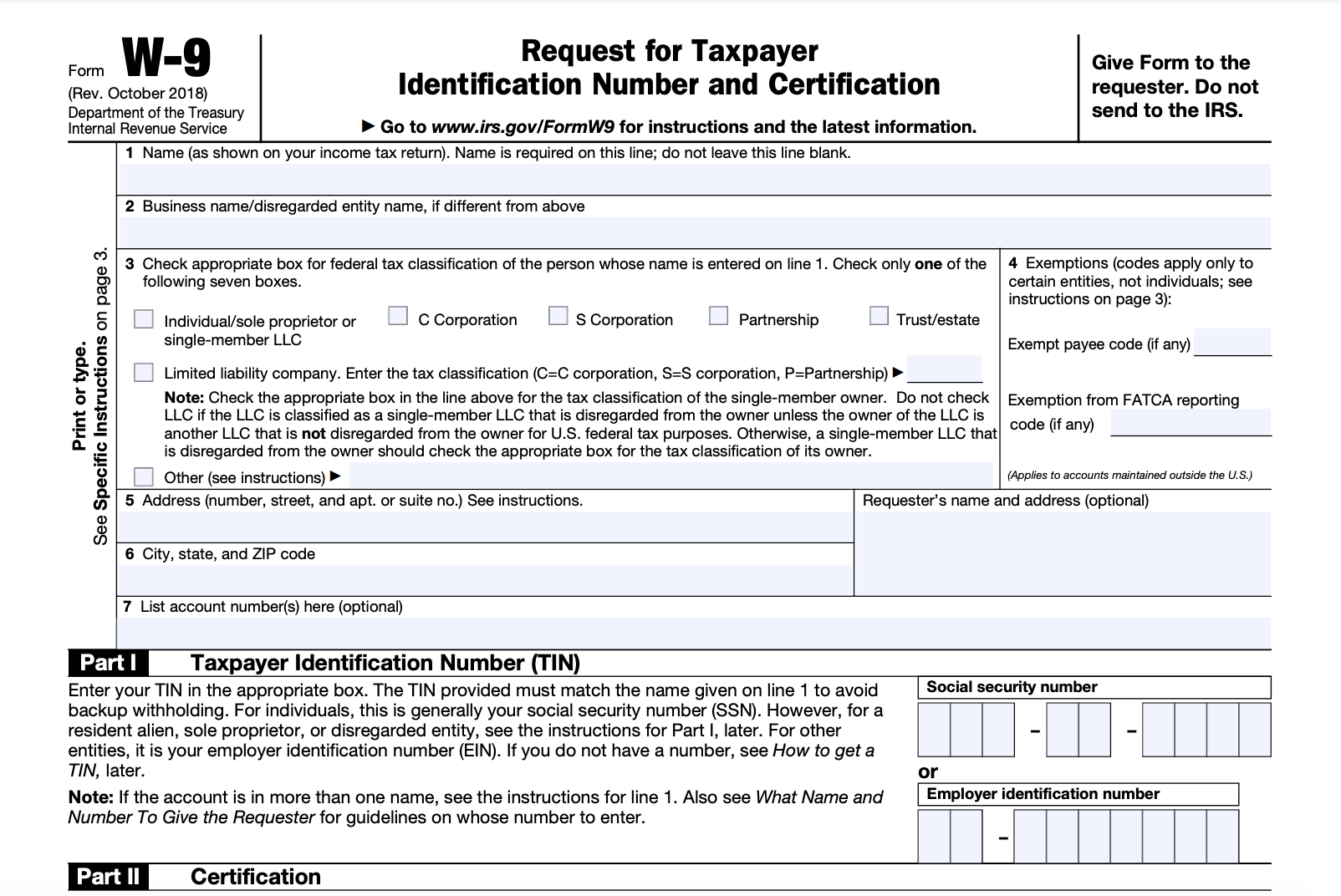

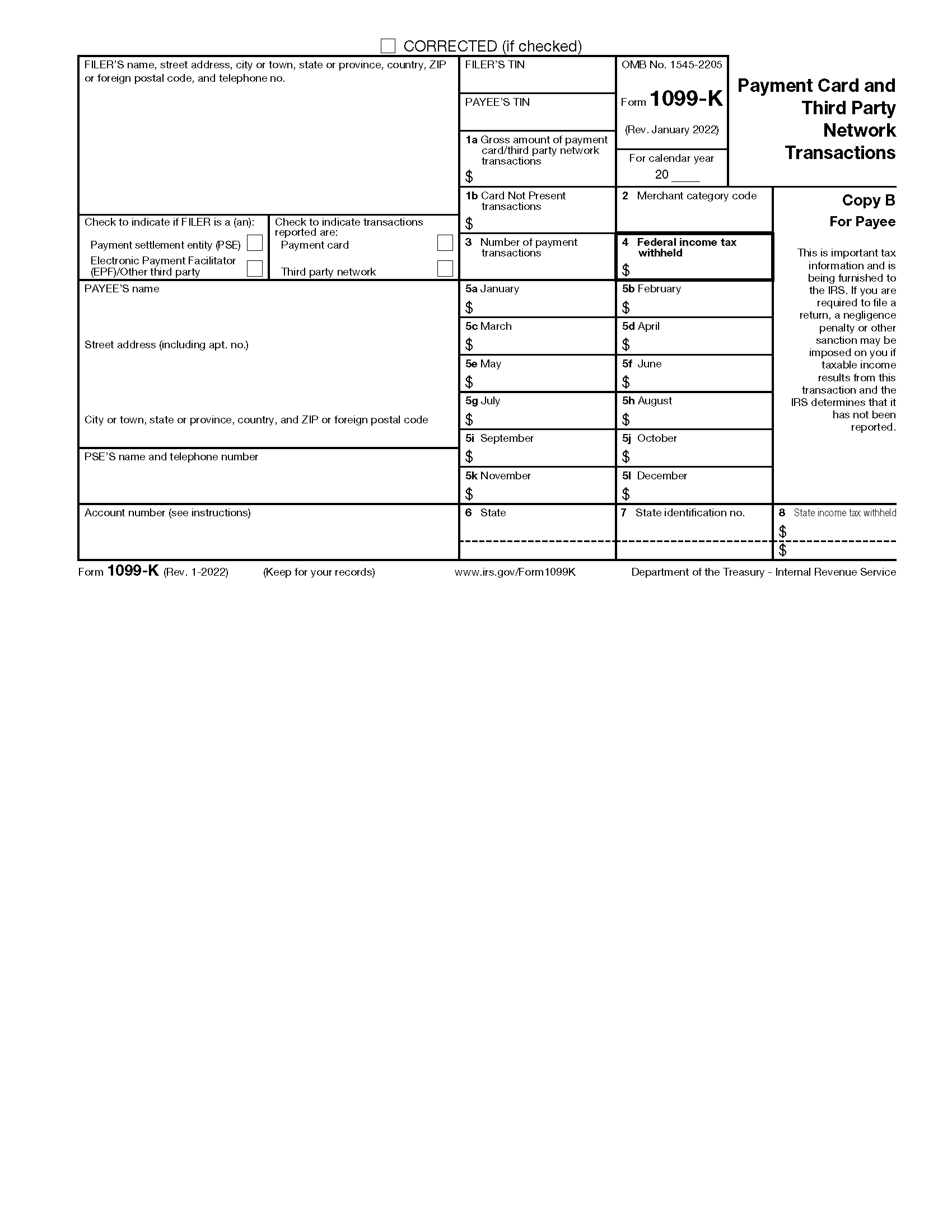

Free Irs Tax Forms Printable

Free Irs Tax Forms Printable

Disclaimer: AnnaPrintables.Org does not distribute any printable content. This site provides navigational references to openly published resources. Use is limited to personal or educational purposes.

Free Irs Tax Forms Printable Images Gallery

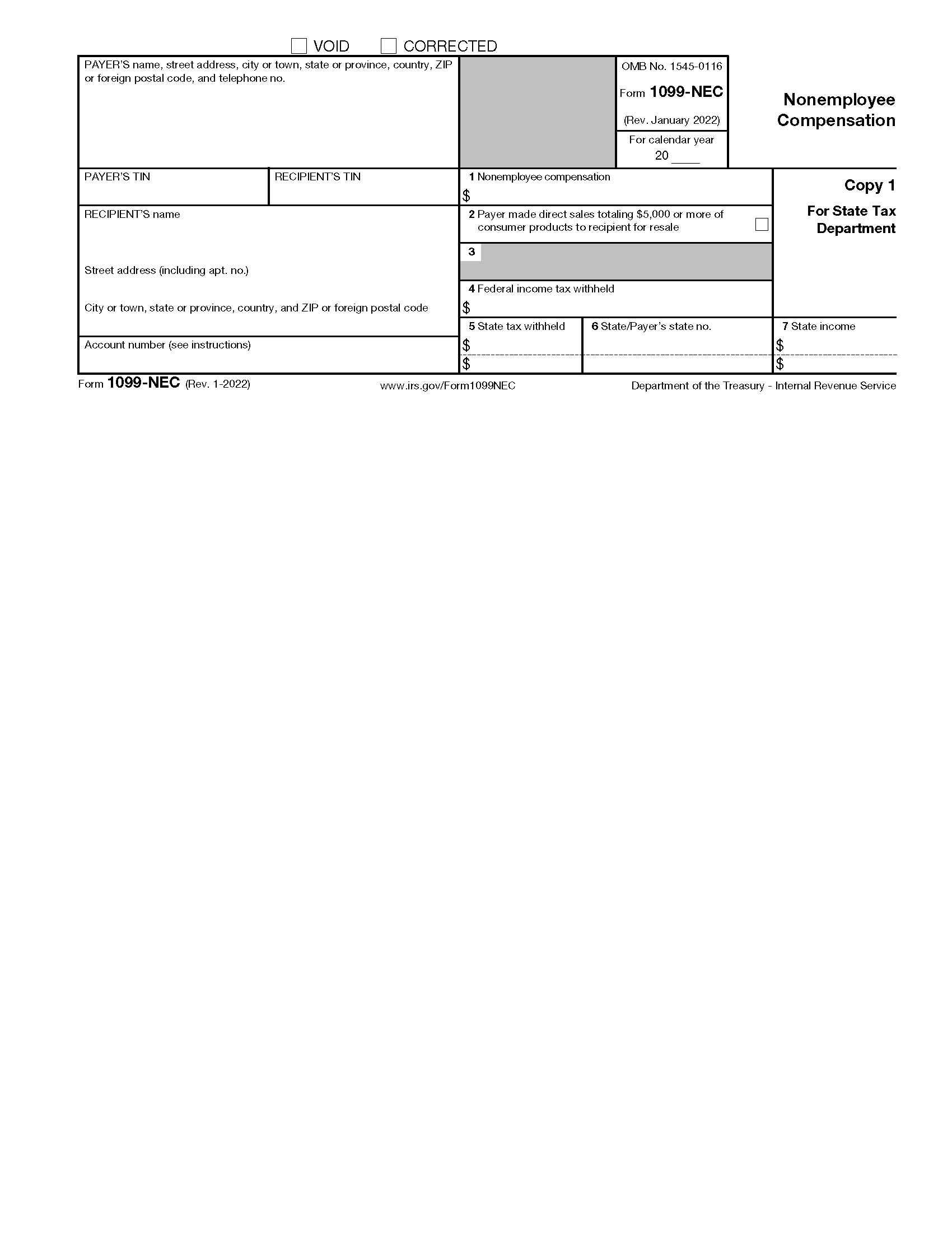

Free IRS 1099 Form - PDF – eForms

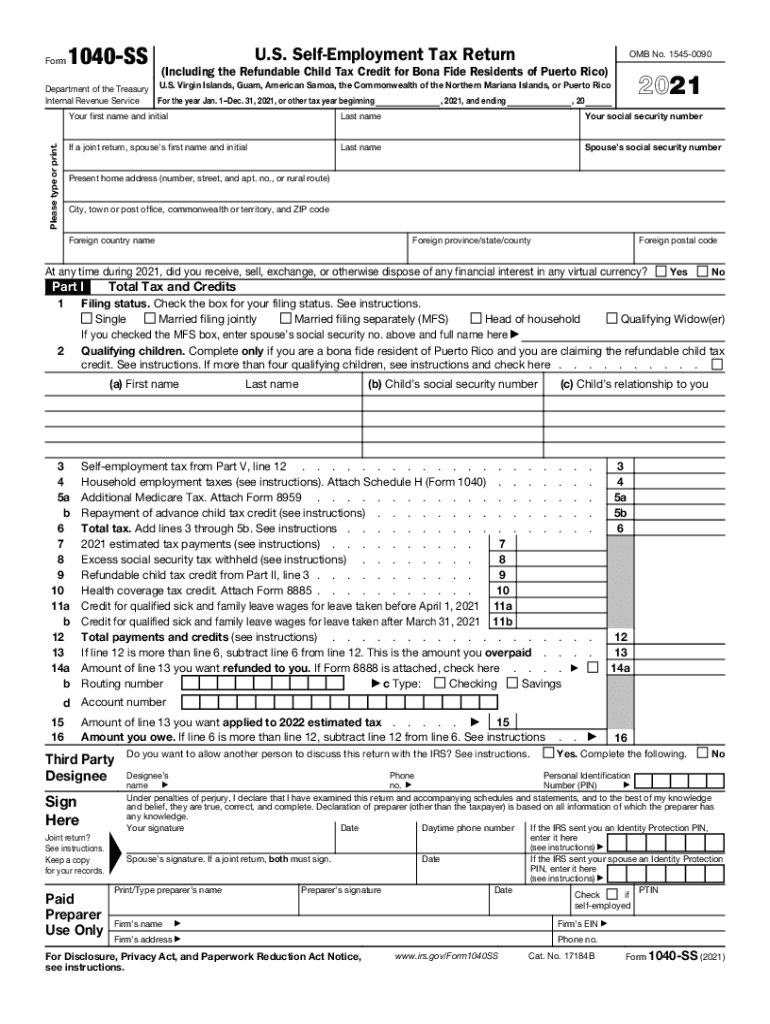

Irs forms 2023 printable: Fill out & sign online | DocHub

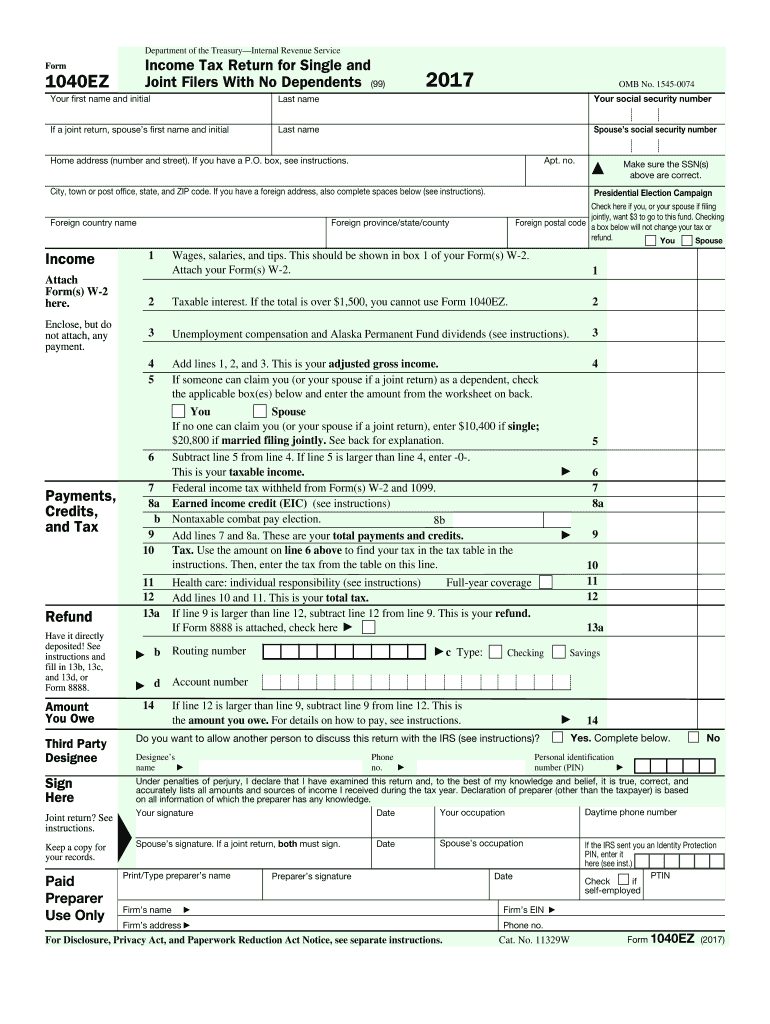

2017-2025 Form IRS 1040-EZ Fill Online, Printable, Fillable, Blank - pdfFiller

Publication 5274 (Rev. 1-2025)

1040 form 2023 printable: Fill out & sign online | DocHub

2024 IRS Form 1099-MISC | Fill Out & Save With Our PDF Editor

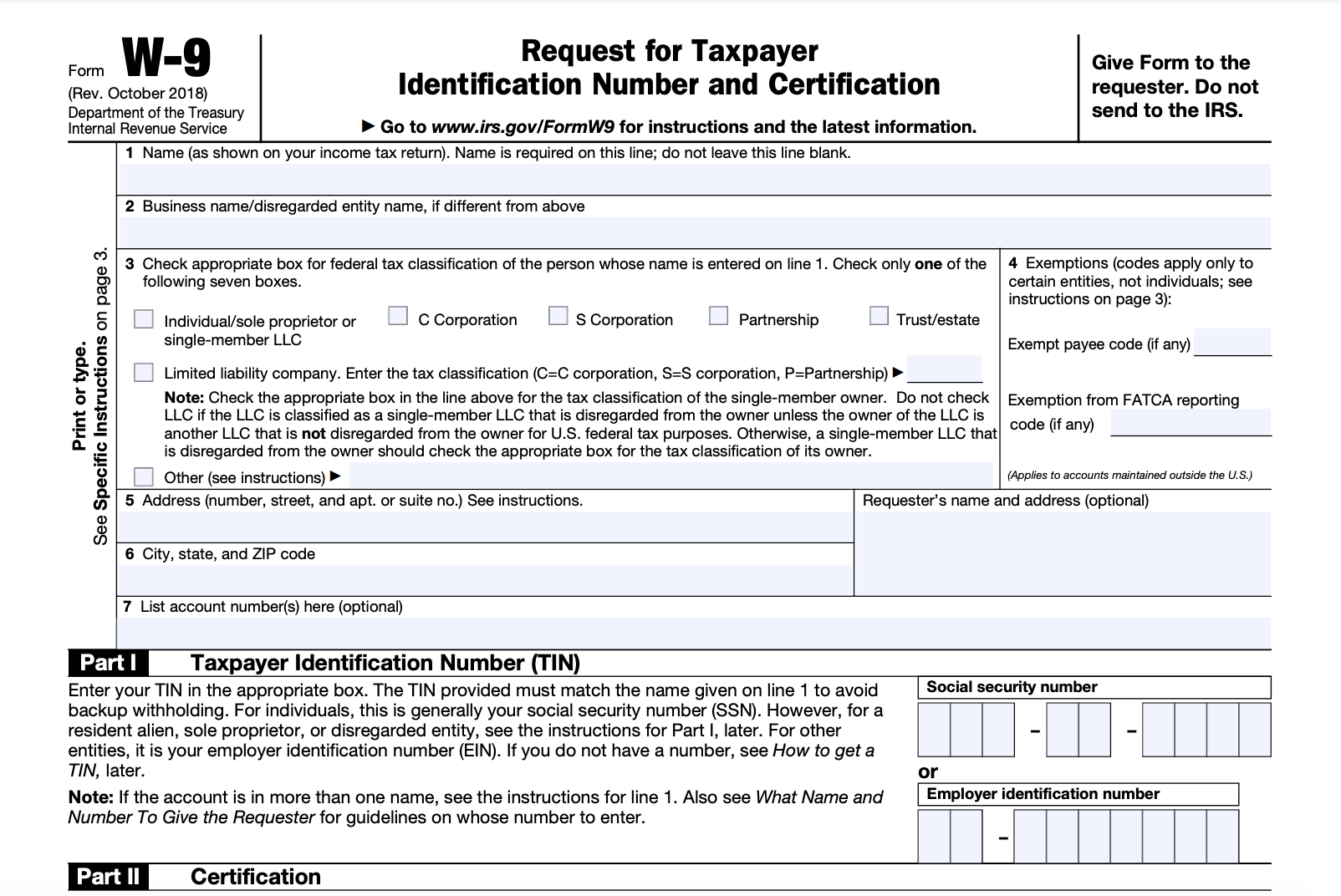

W-9 Form—Fill Out the IRS W-9 Form Online for 2023 | Smallpdf

Free IRS 1099 Form - PDF – eForms

2024 Form IRS 1040 - Schedule A Fill Online, Printable, Fillable, Blank - pdfFiller

2024 IRS Form W-2 | Fill Out, Save, & Print With Our PDF Editor

Reference Questions

1. Where do these files come from?

All printables originate from blogs. This site does not generate any content.

2. Where is the actual download?

Follow the source link (typically below or near the preview) to download the original file.

3. In what format are the files provided?

Most creators distribute files in PNG format. These are widely supported.

4. Are these files editable?

Generally no. Most free printables are image-based to protect design integrity.

5. Is commercial use permitted?

Almost never. Free printables are not cleared for resale or business use.

6. What if a link is broken?

Links are reviewed periodically. Notify us of errors via the contact page for correction.