AnnaPrintables.Org | Free Printable 2290 Tax Form — This page lists publicly available Free Printable 2290 Tax Form published on third-party sites. Files are not stored on the creators’ websites. Links direct users to the publisher’s site where the printable can be accessed at no cost.

Visual samples are displayed for identification and do not represent full resolution. All intellectual property rights remain with the publishing parties. Copyright concerns should be submitted via our contact form.

Free Printable 2290 Tax Form

Free Printable 2290 Tax Form

Disclaimer: AnnaPrintables.Org does not distribute any printable content. This site serves as a link index to freely accessible resources. Use is subject to the creator’s terms.

Free Printable 2290 Tax Form Images Gallery

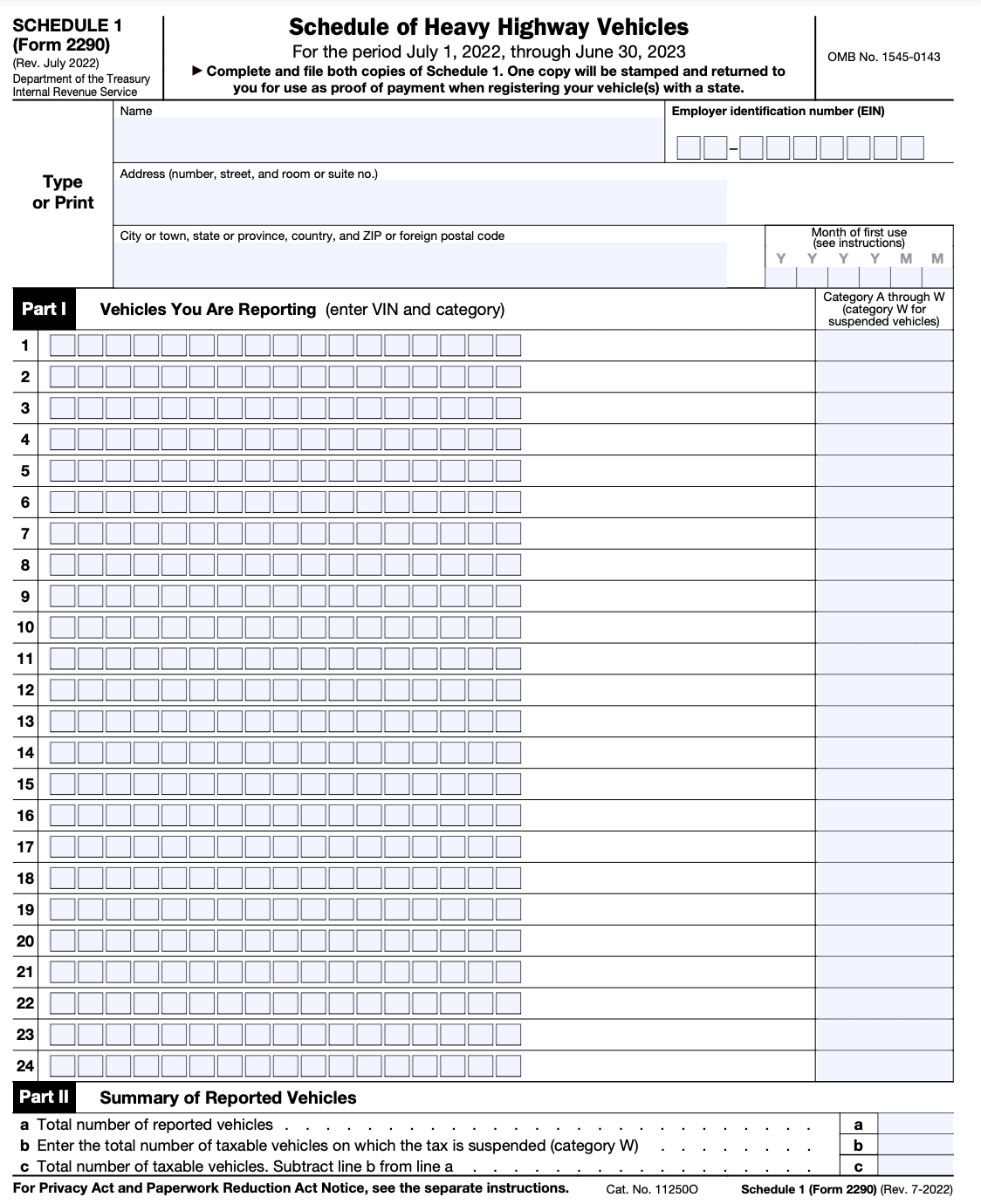

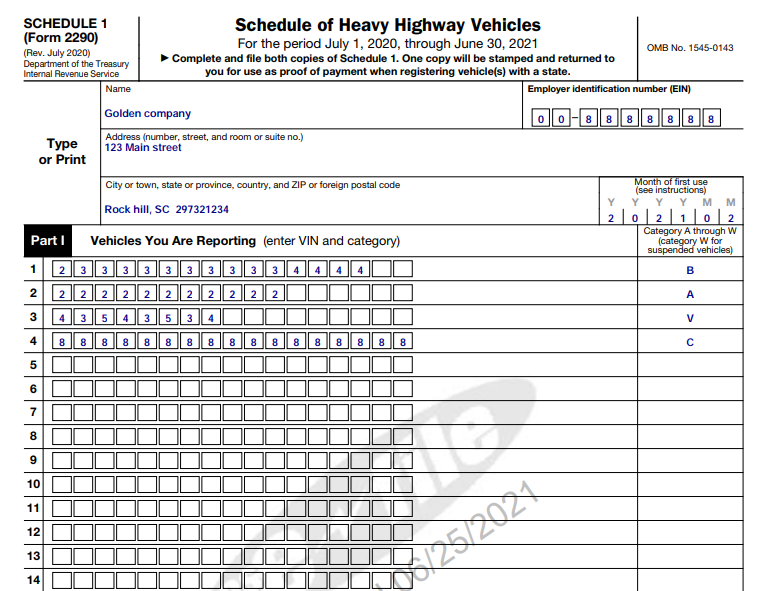

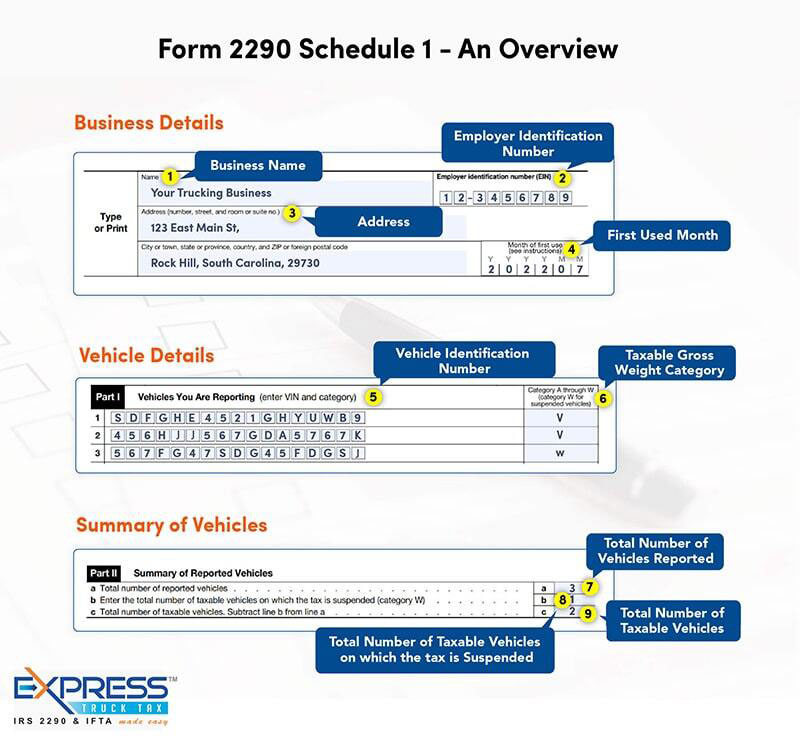

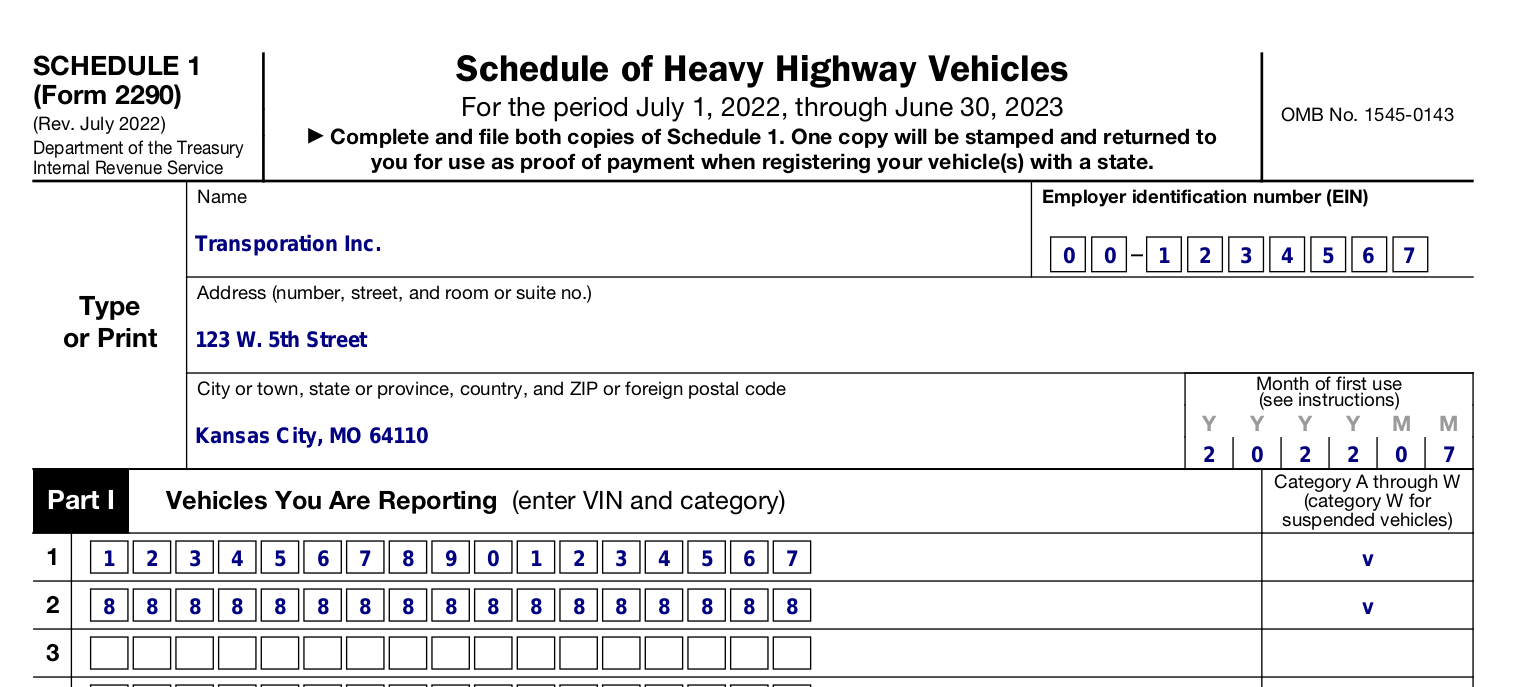

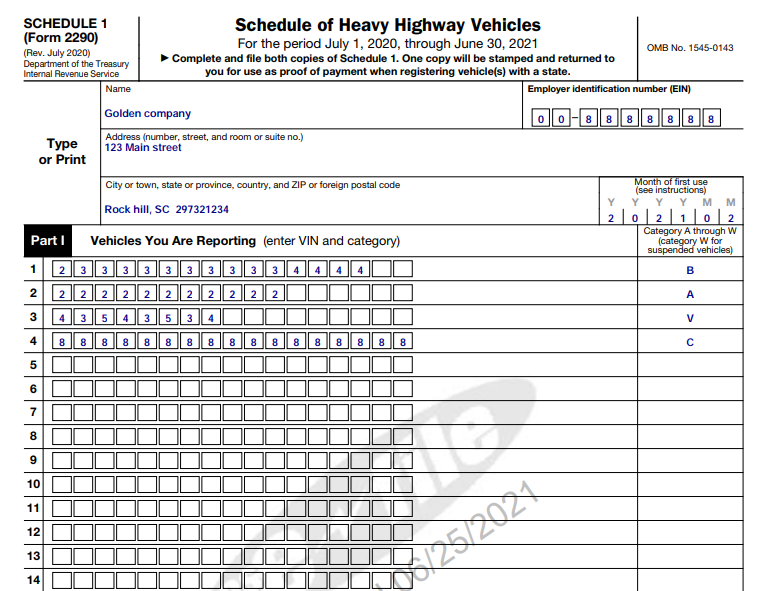

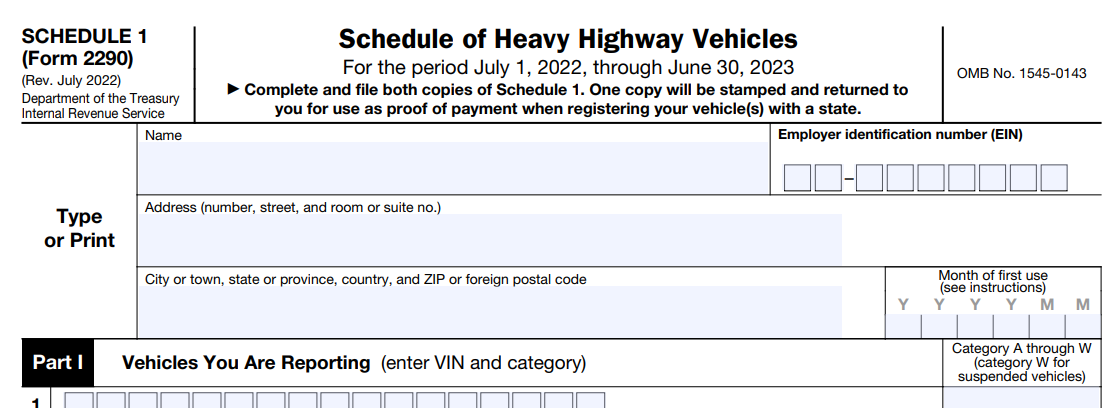

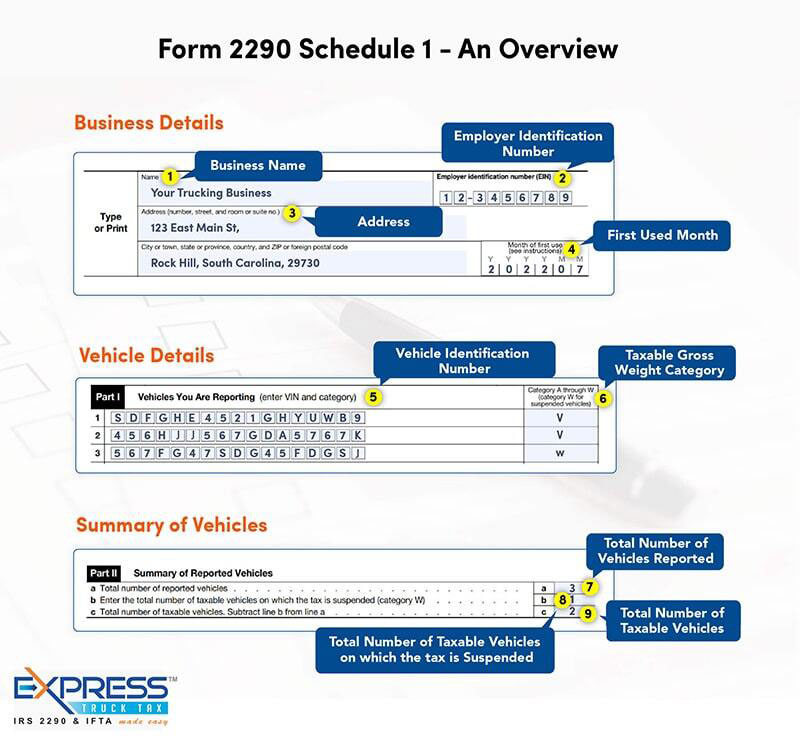

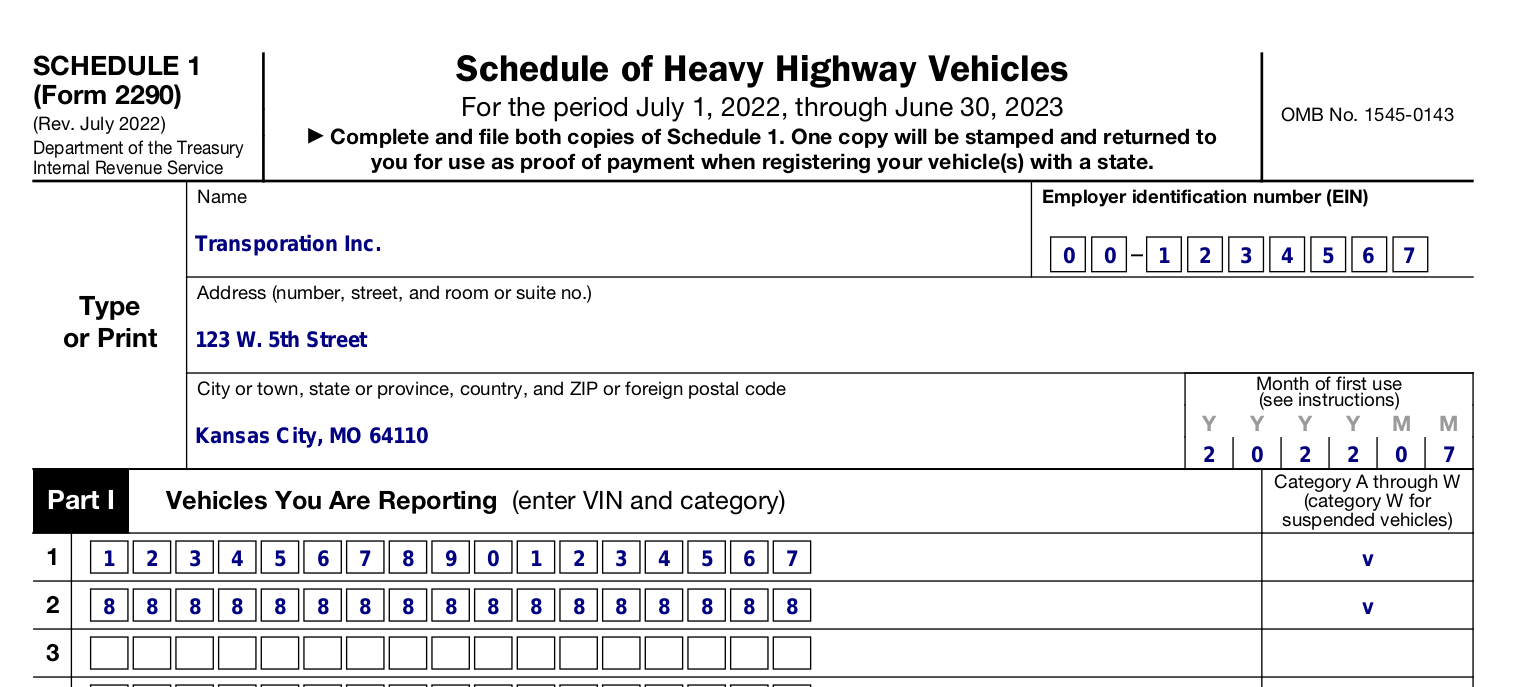

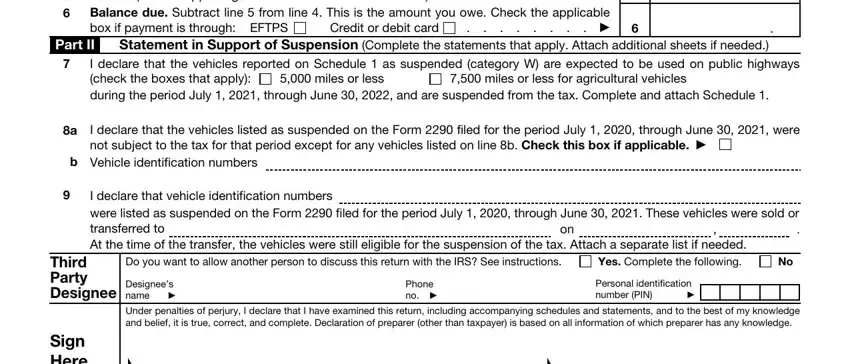

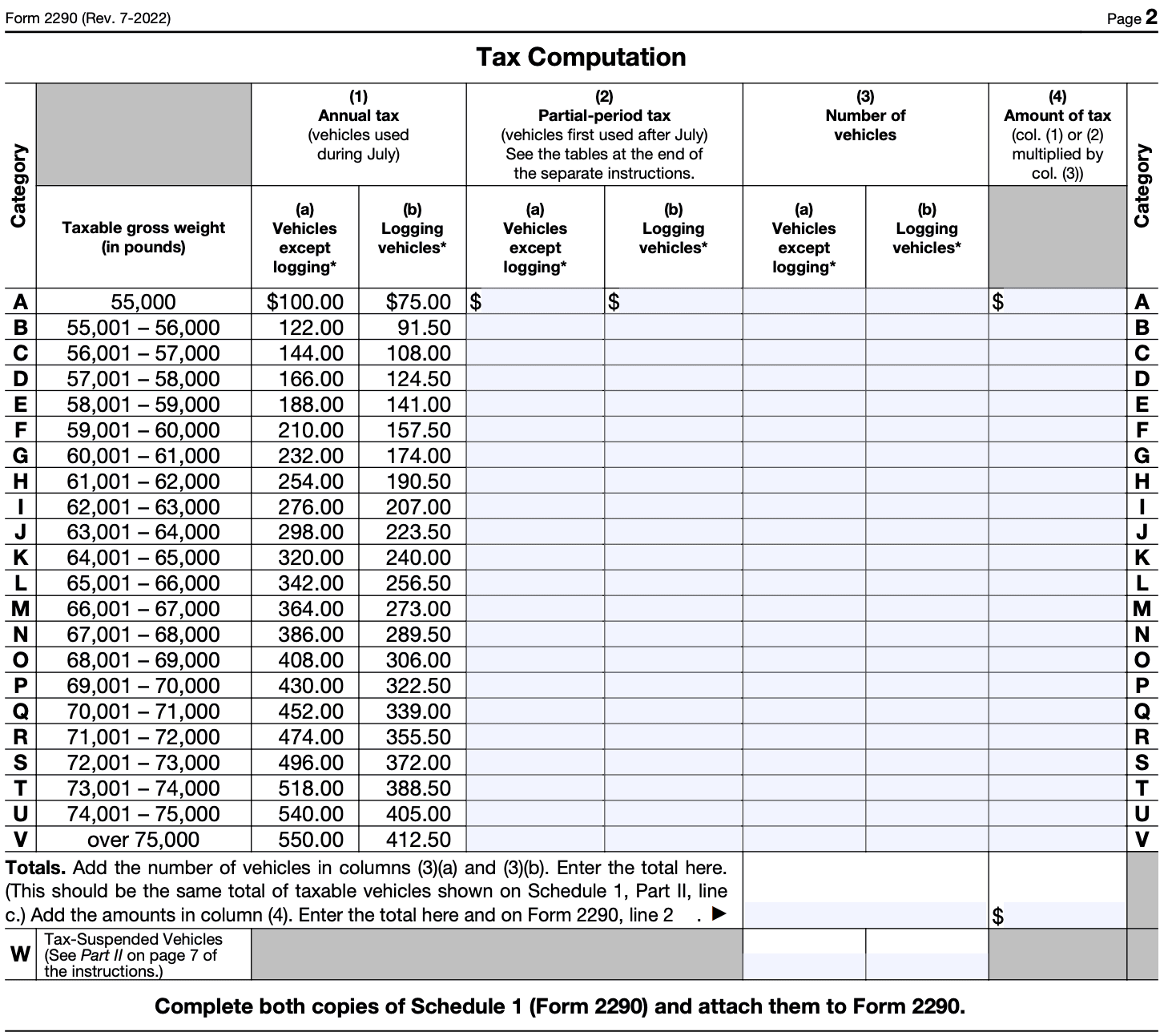

Fillable Form 2290 2023-2024| Create, Fill & Download 2290

Form 2290 - Heavy Vehicle Use Tax

IRS Watermarked 2290 Proof of Payment Schedule 1in Minutes | Tax2290.com

Print Your 2290 Form Easily | Secure E-Filing Solution

Form 2290 ≡ Fill Out Printable PDF Forms Online

How to Get a Copy of Your Paid 2290

IRS Form 2290 Printable (2022) - 2290 Tax Form, Online Instructions & PDF to Print or E-File

Form 2290 ≡ Fill Out Printable PDF Forms Online

Form 2290: Heavy Highway Vehicle Use Tax Return

IRS 2290 Tax Form 📝 2290 Form Printable & 2022-2023 Instructions - Free PDF for Download

Reference Questions

1. Where do these files come from?

All printables originate from educational platforms. This site does not upload any content.

2. How do I access the full-resolution file?

Click through to the original page (typically below or near the preview) to access the printable.

3. In what format are the files provided?

Most creators distribute files in JPG format. These are widely supported.

4. Are these files editable?

Only if specified by the creator. Most free printables are image-based to protect design integrity.

5. Can I sell products using these?

Not without explicit permission. Free printables are intended for personal use.

6. What if a link is broken?

Links are reviewed periodically. Report broken links via the support form for correction.